The COVID-19 pandemic has turned the aviation industry upside down.

As lockdowns and travel restrictions swept across the nation, US airlines faced an unprecedented challenge: how to stay afloat when passenger demand plummeted to record lows?

The pain was felt across the sector, from major carriers to regional airports, as flight numbers dwindled and revenue streams dried up.

But amid the chaos, a glimmer of hope emerged.

By analyzing the impact of COVID-19 on US flight numbers, we can gain valuable insights into how the industry adapted, survived, and positioned itself for a brighter future.

This blog post will examine the data, strategies, and lessons learned from one of the most turbulent periods in aviation history.

COVID-19 Impact on U.S. Flights

The COVID-19 pandemic sent shockwaves across the globe, disrupting industries and altering daily life in unprecedented ways.

With millions infected and economies grinding to a halt, few sectors felt the impact as acutely as air travel.

As nations imposed lockdowns and travel bans to curb the virus’s spread, airlines faced a sudden and dramatic drop in demand.

Passenger flights came to a standstill, and once-busy routes were suspended indefinitely.

The pandemic’s scale and scope were unlike anything the modern world had seen, leaving the aviation industry facing its greatest challenge.

The impact of COVID-19 on US flight numbers was staggering. Domestic flights declined over 70% compared to pre-pandemic levels, while international flights plummeted by more than 90%.

Border closures and travel restrictions significantly affected these changes as countries sought to limit the virus’s spread.

Consumer behavior also shifted dramatically, with many people opting to avoid travel due to health risks and economic uncertainty.

The combination of these factors created a perfect storm that brought air travel to its knees.

Pre-COVID-19 Baseline

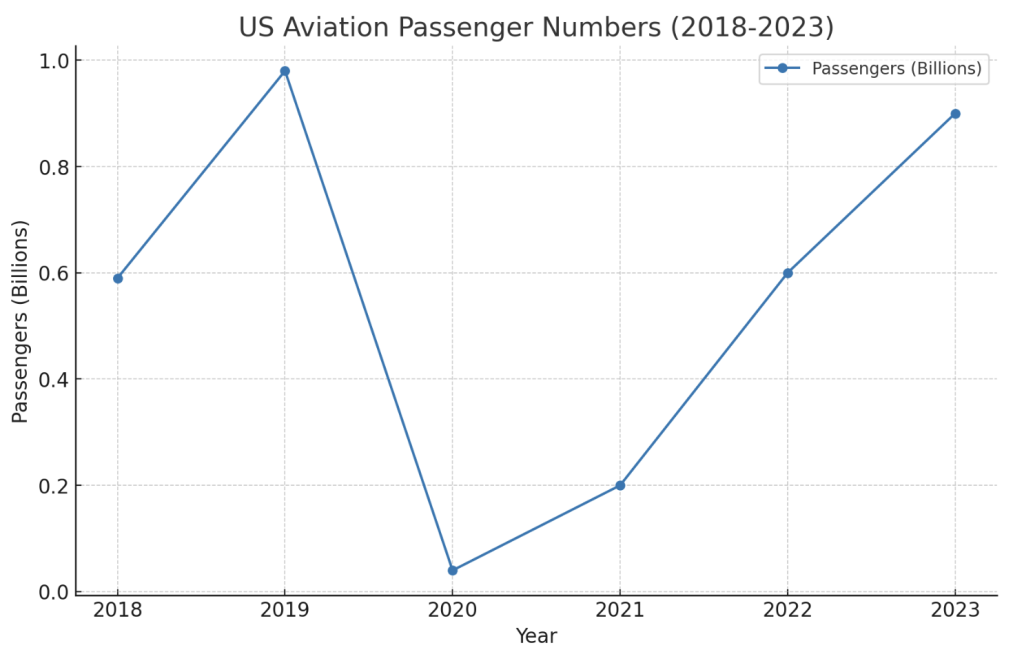

Before the pandemic, US airlines operated over 25,000 flights daily, carrying millions of passengers monthly.

The industry followed predictable seasonal trends, with peak travel periods during holidays and summer.

In 2019, the US aviation industry thrived, with almost 1 billion annual passengers generating nearly $500 billion.

The domestic US passenger market was the largest globally, with 590 million passenger journeys in 2018.

The number of air passengers has steadily increased since the 1970s, with over 5,000 aircraft in the US airspace during peak hours.

In the months before the pandemic, flight numbers and passenger volumes were consistent with historical averages, showing no signs of an impending crisis.

This baseline starkly contrasts the industry’s performance after COVID-19, highlighting the pandemic’s devastating impact.

COVID-19’s Immediate Impact on U.S. Flights

As the pandemic took hold, US airlines felt the impact immediately.

In April 2020, total aircraft operations within the US dropped by 79% at its worst, reflecting a significant decrease in air passengers.

Passenger air travel was severely depressed, dropping by 96% in April 2020 compared to the previous year.

Air cargo capacity decreased by 28% in July 2020, impacting the aviation industry across various sectors.

International flights faced the most severe disruptions, with travel restrictions and border closures leading to a nearly complete halt in passenger traffic.

Domestic flights fared slightly better but still saw massive declines as states imposed stay-at-home orders and consumers grew wary of travel.

Airlines responded by canceling flights, grounding fleets, and implementing new health safety measures to reassure passengers.

However, the collapse in demand proved too much to overcome, with even the most optimistic projections showing a long road to recovery.

As the pandemic stretched into 2020 and 2021, the aviation industry saw a gradual increase in flight numbers, though recovery was far from linear.

Travel restrictions remained a persistent challenge, with changing guidelines and varying quarantine requirements across states and countries.

The recovery patterns varied significantly by region, influenced by local COVID-19 policies and vaccination rates.

As of 2023, the global airline capacity is poised to surpass its 2019 levels, marking a major milestone in the industry’s recovery.

While the industry has shown resilience and adaptability, challenges remain, with profit levels projected to be less than 40% of 2019 levels.

The return to pre-pandemic flight capacity indicates the industry’s ability to adapt to changing conditions.

Still, factors like depressed travel to and from China, aircraft supply bottlenecks, and rising costs pose ongoing challenges.

Some states, such as Florida and Texas, saw a faster rebound in air travel.

In contrast, others, like New York and California, experienced a more sluggish recovery due to stricter lockdown measures.

Airlines introduced various health measures to restore passenger confidence, including mask mandates, enhanced cleaning protocols, and COVID-19 testing requirements.

These measures and the rollout of vaccines played a crucial role in encouraging people to fly again.

However, passenger response to these measures was mixed, with some embracing the added safety precautions and others finding them cumbersome and restrictive.

Long-Term Trends and Future Outlook

The pandemic has triggered structural shifts in the aviation industry that will likely persist long after the virus is contained.

Shifts in Passenger Mix and Travel Patterns

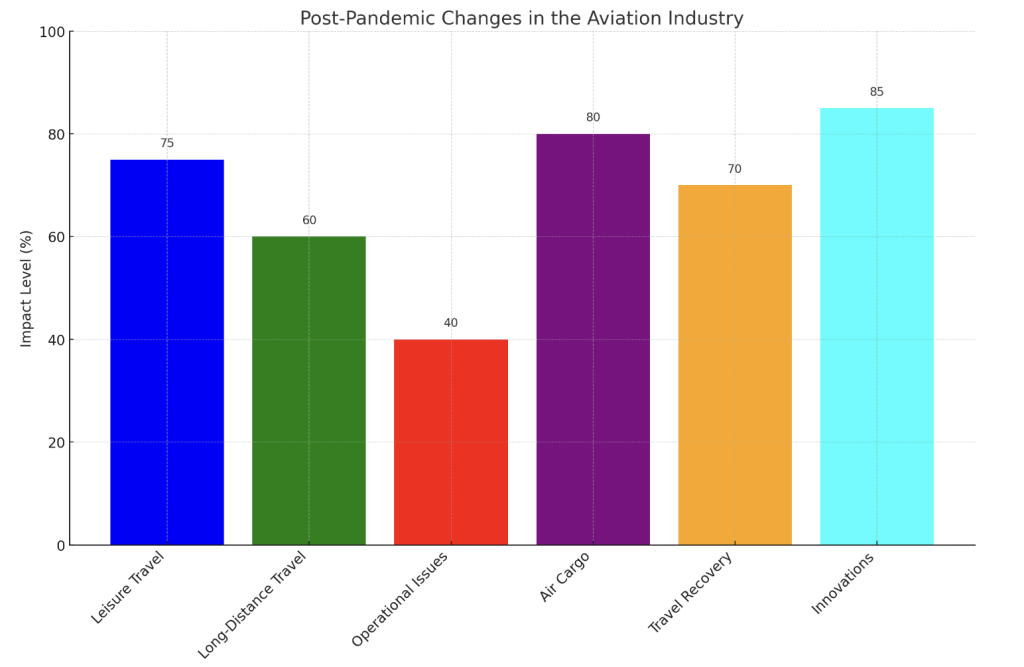

There has been a shift towards more leisure travel and a decline in business travel due to the rise of remote work and videoconferencing.

This shift could have significant implications for airline revenue models, which traditionally rely heavily on high-yield business travelers.

The number of long-distance trips (50 or more miles) increased by 10% in 2020 compared to 2019, while overall trips declined.

Operational Challenges and Labor Shortages

Airlines have faced operational performance challenges such as crowded planes, overbooking, and delays due to labor shortages in areas like baggage handling and air traffic control.

Pilot shortages remain a major issue, as the pandemic merely paused a longer-term problem in the industry.

Air Cargo and Network Experimentation

The air cargo sector has shown robust performance, with specific regions, such as Latin America and North America, seeing significant growth.

Airlines have experimented with new routes, particularly in Europe and Asia Pacific, as they seek to seize opportunities in a time of uncertainty.

Economic and Financial Consequences

The pandemic has devastated airline profitability, with the industry losing billions of dollars in revenue due to the sharp decline in passenger numbers and the grounding of fleets.

Governments provided various aid packages, including loans, grants, and payroll support to prevent massive layoffs and sustain operations.

The economic fallout from the pandemic has extended far beyond the airline industry itself.

Airports have seen a significant reduction in revenue from passenger traffic, parking fees, rentals, and concessions.

The tourism industry has also been hit hard, with many destinations experiencing a sharp drop in visitor spending and local businesses struggling to stay afloat.

The hospitality sector, including hotels and event venues, has faced a similar downturn due to canceled bookings and reduced travel.

As airlines look to the future, they are reassessing their investment plans and prioritizing sustainability and health security measures.

Fleet upgrades and route expansions may be put on hold as carriers focus on rebuilding their financial stability and adapting to the new market realities.

Recommendations and Strategic Responses

Airlines must prioritize rebuilding customer trust and adapting to new travel patterns to navigate the post-pandemic landscape successfully.

This will require a multifaceted approach, including enhanced safety protocols, transparent communication, and flexible booking options that accommodate the ongoing uncertainty.

Airlines should continue to invest in health and safety enhancements, such as HEPA filters, mandatory mask policies, and touchless technologies.

These measures protect passengers and crew and demonstrate the industry’s commitment to public health.

Offering more flexible travel options, such as easy changes and cancellations, will also restore consumer confidence and encourage people to book flights.

Governments can support the industry’s recovery by providing ongoing financial assistance and adjusting regulations to facilitate adaptation to new health guidelines.

This may include extending payroll support programs, waiving certain fees or taxes, and streamlining approval processes for new safety measures.

As airlines seek to diversify their revenue streams, they may explore opportunities such as expanding cargo services or transforming passenger cabins for freight transport.

Investing in digital technologies can also help improve operational efficiency and enhance the customer experience, from contactless check-ins to personalized in-flight services.

Finally, airlines should be tuned to travelers’ evolving preferences and identify markets or segments that could drive growth as recovery progresses.

Domestic travel and nature-based destinations that allow for social distancing may see increased demand, while business travel and crowded urban destinations may take longer to rebound.

By embracing innovation, prioritizing health and safety, and remaining agile in the face of change, the aviation industry can emerge stronger and more resilient from this crisis.

Conclusion

The COVID-19 pandemic has profoundly impacted the US aviation industry, with flight numbers plummeting to record lows and airlines facing unprecedented challenges.

However, the industry has shown remarkable resilience in adapting to the new reality through health measures, technological innovations, and government support.

As we progress, rebuilding customer trust and staying attuned to evolving travel preferences will be key to the industry’s long-term recovery.

While the road ahead may be turbulent, the lessons learned from this crisis will undoubtedly shape the future of air travel, making it safer, more efficient, and more sustainable than ever before.

As passengers, we can play our part by supporting the industry’s efforts and embracing the changes that will define the new era of aviation.