Many people believe that Texas offers an affordable lifestyle compared to other states, but they may not know why.

Several economic factors contribute to the Lone Star State’s budget-friendly living costs.

In this blog post, we’ll explore the key drivers that make Texas an attractive place to call home, from its unique tax structure and diverse job opportunities to its efficient building processes and lower cost of living.

By the end, you’ll understand why Texas remains a top choice for those seeking an affordable place to live without sacrificing the quality of life.

Abundance of Land and Development Opportunities in Texas

Texas’ vast expanse of buildable land is a significant factor in keeping the state’s housing prices affordable.

With ample space for new construction, developers can create homes and communities at competitive prices, making homeownership more accessible to a wider range of people.

1. Plentiful Land, Lower Costs

One of the primary reasons Texas maintains its affordable housing market is the abundance of available land.

Unlike densely populated states where land is scarce and expensive, Texas offers plenty of room for growth and development.

This abundance of buildable land helps keep real estate prices in check, as developers don’t have to pay exorbitant prices for plots to build on.

2. Texas vs. Other States: A Comparison

Compared to more densely populated states like California or New York, the difference in land availability becomes clear.

While these states grapple with limited space and high demand, driving up real estate prices, Texas benefits from its expansive geography.

For example, according to the U.S. Department of Agriculture, the average price per acre of land in Texas is $2,650; in California, it’s a staggering $39,092.

This allows for more development opportunities and helps maintain a more balanced housing market, ensuring that people from various economic backgrounds can find affordable places to call home.

State of Texas: Tax Structure and Its Impact on Affordability

Texas’ unique tax structure plays a significant role in making the state an affordable place to live.

By not imposing a state income tax, Texas allows residents to keep more of their hard-earned money, which can be put towards housing and other living expenses.

1. No State Income Tax: More Money in Your Pocket

One of the most notable aspects of Texas’ tax structure is the absence of a state income tax.

This means that residents don’t have to pay a portion of their income to the state government, allowing them to retain more earnings.

According to the Tax Foundation, this extra money can amount to thousands of dollars per year for the average household, which can be used to offset housing costs, making homeownership or renting more affordable for Texans than residents of states with higher income taxes.

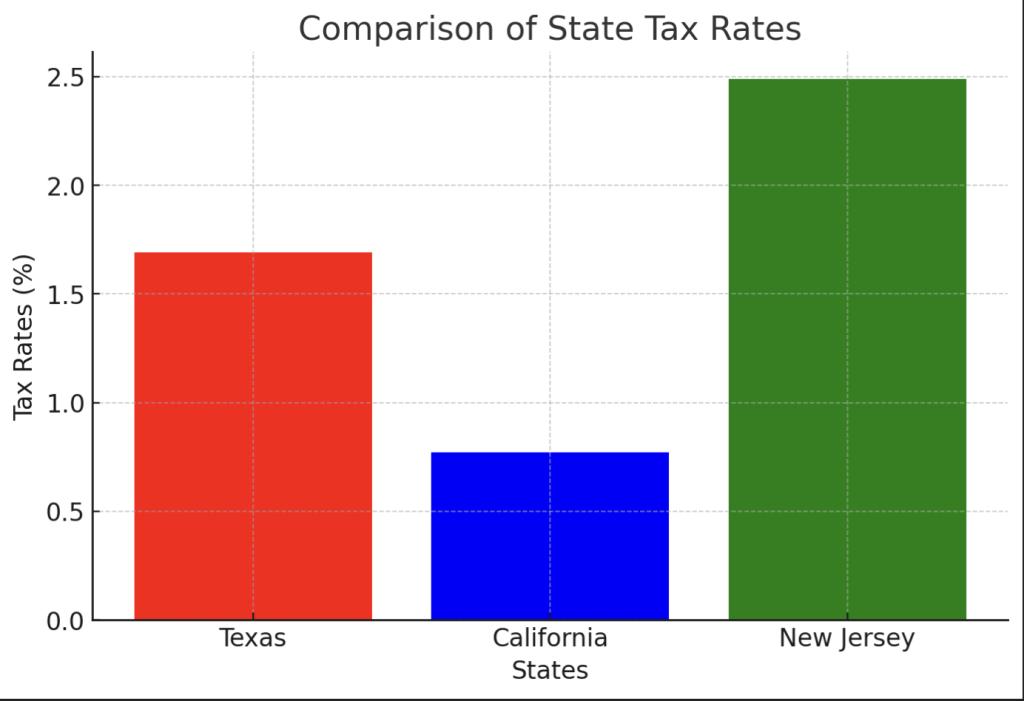

2. Property and Sales Taxes: A Balancing Act

While Texas does not have a state income tax, it relies on property and sales taxes to generate revenue.

However, these taxes are generally lower than in many other states, helping keep living costs down.

Additionally, Texas offers various property tax exemptions and deductions, such as the homestead exemption, which can further reduce homeowners’ tax burden.

In fact, according to CNBC, the effective property tax rate in Texas is 1.69%, compared to 2.49% in New Jersey, one of the highest in the nation.

3. Low Business Taxes: Stimulating Growth and Affordability

Texas’ business-friendly tax environment also contributes to the state’s affordability. With low business taxes, companies are more likely to shop in Texas, creating jobs and stimulating economic growth.

This, in turn, can lead to higher wages and more opportunities for residents, making it easier to afford housing and other living expenses.

Furthermore, when businesses save on taxes, they can pass those savings on to consumers through lower prices for goods and services, further enhancing overall affordability.

According to the Tax Foundation, Texas ranks 11th for its overall business tax climate, making it an attractive destination for companies and entrepreneurs.

Texas’s Economic Growth and Job Opportunities

Texas’ thriving economy and strong job market are key factors in the state’s affordable living landscape.

With a diverse range of industries and a steady influx of new residents, Texas has balanced housing demand with supply, keeping prices relatively stable.

1. A Robust Job Market Across Sectors

Texas boasts a vibrant job market, with opportunities spanning various sectors such as energy, healthcare, technology, and education.

Major companies like ExxonMobil, AT&T, and Dell Technologies have their headquarters in Texas, contributing to the state’s economic strength.

This strong employment landscape attracts people from all over the country, increasing the demand for housing.

However, the state’s commitment to new developments and construction helps keep pace with this demand, ensuring that housing prices remain reasonable.

2. Population Growth and Migration: A Balancing Act

As more people move to Texas for job opportunities and a lower cost of living, the state’s population continues to grow.

According to the U.S. Census Bureau, Texas’ population grew by 3.85 million people between 2010 and 2020, the largest increase of any state in the nation. This growth pressures the housing market as more people seek affordable housing.

However, Texas’ abundant land and pro-development policies help balance this increased demand by allowing for the construction of new homes and communities, preventing housing prices from skyrocketing.

3. Economic Resilience and Diversity: A Stable Foundation

Texas’ economy is known for its resilience and diversity, which contributes to the housing market’s stability.

Unlike states that rely heavily on a single industry, Texas’ varied economic landscape helps it weather economic downturns and maintain steady growth.

In fact, according to the Bureau of Economic Analysis, Texas’ GDP grew by 8.0% in Q4 2021, outpacing the national average of 6.9%.

This stability is reflected in the housing market, where prices are less likely to experience drastic fluctuations, providing a sense of security for homeowners and renters alike.

Cost of Construction and Housing Supply in Texas

Texas’ regulatory environment and access to local construction materials are significant in keeping housing costs affordable.

However, the state also faces challenges in ensuring the housing supply keeps up with the growing demand, particularly in urban areas.

1. A Regulatory Environment That Supports Affordable Construction

Texas’ construction industry benefits from a regulatory environment that streamlines the building process, making it faster and more cost-effective.

With fewer bureaucratic hurdles and a more efficient permit approval system, developers can quickly break ground on new projects, reducing overall construction costs.

According to the National Association of Home Builders, obtaining a building permit in Texas takes an average of 6.5 months, compared to 10.5 months in California.

This, in turn, allows for the construction of more affordable housing options, helping to meet the demand for budget-friendly homes.

2. Local Materials, Lower Costs

The availability of local construction materials is another factor that helps keep housing costs down in Texas.

With abundant natural resources, such as limestone and timber, builders can source materials from within the state, reducing transportation costs and supporting local businesses.

This easy access to affordable materials allows developers to construct homes at lower prices, translating into more affordable options for buyers and renters.

3. Challenges in Meeting Urban Housing Demand

Despite Texas’ efforts to maintain an affordable housing market, the state still faces challenges in ensuring that the supply of homes keeps pace with the growing demand, especially in urban areas.

As more people move to cities like Houston, Dallas, and Austin for job opportunities and urban amenities, the pressure on the housing market intensifies.

While new developments are continually being built, the rapid population growth in these areas can sometimes outpace construction, leading to temporary shortages and price increases.

However, Texas’ commitment to affordable housing and its pro-development policies help address these challenges and work towards a more balanced market.

Regional Variations Within Texas

| State | Average Time to Obtain Building Permits (Months) | Associated Costs |

|---|---|---|

| Texas | 6.5 | Variable |

| California | 10.5 | Variable |

While Texas as a whole is known for its affordable living, it’s important to recognize that housing costs and affordability can vary significantly across different regions within the state.

Each part of Texas has unique housing market dynamics, from the bustling urban centers to the tranquil rural areas.

1. Urban Centers and Scenic Locations: Higher Property Values

Housing costs in Texas’ major cities, such as Austin, Dallas, and Houston, tend to be higher than the state average.

These urban centers attract many people due to their job opportunities, cultural amenities, and vibrant lifestyles, which drive up demand for housing.

As a result, property values in these areas are typically higher, making homeownership more expensive compared to other parts of the state.

For instance, according to Zillow, the median home value in Austin is $588,115, while in Dallas, it’s $293,549.

Similarly, scenic locations like the Texas Hill Country or coastal regions often command premium prices for real estate.

These areas’ natural beauty and recreational opportunities make them highly desirable places to live, leading to increased housing costs.

2. Affordable Options in Other Regions

While housing costs in urban centers and scenic locations may be higher, Texas offers plenty of affordable options in other regions.

Smaller cities, suburban areas, and rural communities often provide more budget-friendly housing choices without sacrificing quality of life.

For example, cities like San Antonio, El Paso, and Lubbock have lower median home prices than their larger urban counterparts, making homeownership more accessible to a wider range of people.

According to Zillow, the median home value in San Antonio is $256,301, while in El Paso, it’s $171,205.

These areas still offer a variety of job opportunities, amenities, and a strong sense of community, all while maintaining a more affordable cost of living.

Housing costs in rural areas are often significantly lower than in urban centers.

With more land available and a slower pace of life, these regions provide an attractive option for those seeking affordable housing and a quieter lifestyle.

Common Myths and Misconceptions About Buying Houses in Texas

Despite Texas’ reputation for affordable living, there are still some common myths and misconceptions surrounding the state’s housing market.

Addressing these misunderstandings will provide a more accurate picture of the real estate landscape in Texas.

Myth: Housing Prices Are Universally Low Across Texas

One common misconception is that housing prices are uniformly low throughout Texas.

While Texas generally offers more affordable housing options than many other states, it’s crucial to recognize that prices can vary significantly depending on the location within the state.

As mentioned earlier, urban centers and scenic areas tend to have higher property values, while smaller cities and rural regions offer more budget-friendly options.

Researching specific areas within Texas is essential to understand the local housing market and its affordability clearly.

Myth: The Texas Housing Market is Stagnant

Another myth is that the Texas housing market is stagnant, and properties do not appreciate over time.

This couldn’t be further from the truth. The Texas housing market has shown steady growth and appreciation rates.

According to the Texas Real Estate Research Center at Texas A&M University, the statewide median home price increased by 13.4% from 2020 to 2021, indicating a strong and growing housing market.

While appreciation rates may vary depending on the location and market conditions, Texas has a track record of providing solid returns on real estate investments.

It’s important to remember that the Texas housing market is dynamic and constantly evolving.

By staying informed about local market trends, economic factors, and regional variations, homebuyers, sellers, and investors can make more accurate decisions and take advantage of the opportunities provided by Texas’ unique and affordable housing landscape.

Conclusion

Texas’ affordable living is driven by a unique combination of economic factors that set it apart from other states.

From its abundant land and diverse job opportunities to its tax-friendly policies and lower construction costs, Texas offers a compelling case for those seeking an affordable place to call home.

While housing prices and affordability may vary across different regions, Texas’ commitment to maintaining a balanced and accessible housing market is evident.

By understanding the key drivers behind Texas’ affordability, potential residents and investors can make informed decisions about relocating or investing in the Lone Star State.

As Texas continues to grow and evolve, it remains dedicated to preserving its reputation as an affordable and welcoming place to live, work, and thrive.

With a strong economy, a business-friendly environment, and a focus on maintaining a high quality of life, Texas is poised to remain a top destination for those seeking an affordable and fulfilling lifestyle.